Changes to corporate income tax will alter the incentives and rewards for less than a third of aggregate business investment in Australia as there are many financial paths that link different savers who provide funds to different business investors. Company income tax has no role in the effective tax rates on business investment by unincorporated businesses and investment by companies funded by debt. Moreover, with the imputation system, changes in company income tax do not change the effective tax rate for company investment funded by resident shareholders when the returns are distributed as dividends; and for retained earnings company income tax changes are partly muted. The largest category of business investment directly affected by changes to company income tax is company investment funded by non-resident shareholder equity.

Multiple different saving and investment paths

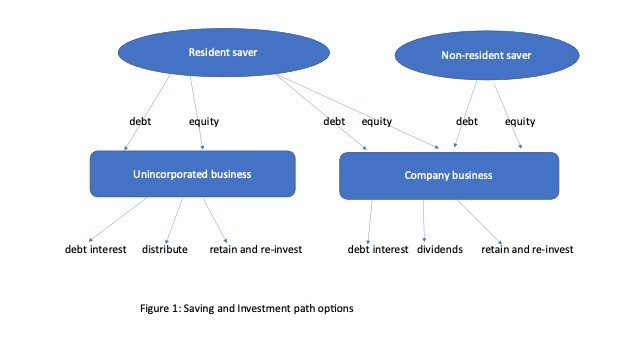

In an Australian Economic Review paper, I describe the different financial paths which link savers who provide funds with different business investors. As shown in Figure 1, savers can be either a resident or a non-resident, and funding can be in the form of equity or debt and often via financial intermediaries. There are also different forms of investor – companies and unincorporated businesses – and income generated can be distributed or retained. These different financial paths have different mixes of attributes sought by different savers and investors. As a result, the different savings to investment paths are imperfect substitutes with different market returns and prices.

One of many important attributes of the different funding options is different income tax treatments, of which company tax is only one element. Taxation of capital income generated by business investment can be collected from the saver, the investor or both. Different funding options bear different effective tax rates measured as the difference between the pre-tax return earned by the investor and the after-tax return received by the saver.

Changes to company income tax, including changes to the tax base and the tax rate, have different effects on the effective tax rates for the different funding options. For many funding options, this could mean no real change to the effective tax rates, and for others, a muted effect.

Taxation of unincorporated business investments

Unincorporated businesses include the self-employed, partnerships and trusts. They are responsible for about 30% of business investment.

For them, personal income tax is levied on the saver in receipt of income generated by investments by unincorporated businesses funded by equity and debt. Changes in company income have no direct effects on the capital income returns generated by this set of investment decisions.

Taxation of company investments

For investments by companies, different tax systems and effective tax rates apply for debt and equity, for income distributed as dividends and retained for further investment, and for resident and non-resident savers. Company income tax is collected from the company as investor as a tax on the residual return to shareholder equity funds.

Debt interest is a deduction for company income tax, with the interest income taxed at the personal rate for resident individuals, a flat rate for superannuation funds, and a very low withholding tax rate specified in bilateral international tax treaties for non-resident provided funds. Changes in company income tax have no direct effect on the effective tax rate for both resident and non-resident debt funded company investment. About 40% of company business investment is debt funded.

Company income taxation is a key component of the effective tax burden on company investment funded by equity funds, but there are other drivers of the effective tax burden. In the case of resident provided equity funds and income distributed as dividends, under the imputation system company income tax operates as a withholding tax accredited to personal income tax of individual shareholders and the flat income tax of superannuation funds. For resident provided equity funds and retained earnings, any company income tax paid is part of a double taxation effectively borne by the saver.

The effective tax rate on retained earnings often is lower than the statutory rate because of special exemptions, overseas income and past losses. A lower company income tax burden associated with a lower rate, or a smaller tax base, will reduce the effective tax burden on investment income retained for further investment that is funded by resident equity, but by a muted effect due to the current effective rate being lower than the statutory rate.

Different tax treatments and effective tax rates apply for income earned on investment funded via equity provided by non-residents to Australian companies. For fully franked dividends, about a half of dividends received by non-residents, the statutory corporate tax rate is the effective tax rate. For non-franked dividends with no company tax paid, a relatively low withholding tax rate set by bilateral international tax treaties applies. Retained earnings on non-resident shareholder funded business investment are subject to company income tax, but usually at a lower effective rate than the statutory rate because of deductions from the income tax base on what are residual returns after payment of franked dividends.

In general, no capital gains taxes are levied by Australia on non-resident shareholders. Then, lower company income taxation fully flows through to lower effective tax rates for franked dividends, and by less than the statutory reduction for unfranked dividends and for retained earnings.

Limited second round changes to portfolio mixes

The different saving and investment paths linking savers and business investors have different mixes of valued attributes. Valued attributes include average return, variability and reliability of returns, management control, and effective tax rates. As a result, the different funding paths are imperfect substitutes, and most savers and investors hold a portfolio mix of the different options. The imperfect substitute characteristics limit the second-round market adjustments of portfolio mixes to changes in relative effective tax rates across the different saving and investment paths of lower company income tax rates discussed above. Two examples illustrate.

One, the largest impact of a lower company income tax rate would reduce the effective tax rate on non-resident equity funded company investment. But there would be no change to the effective tax rate on unincorporated businesses and on non-resident debt funded company investment. Imperfect substitute of large company investments with unincorporated businesses and small resident family owned and operated companies limit expansion of the large company investors benefiting from the lower company tax rate and contraction of investment by small businesses who face no change in effective tax rates.

Two, most non-resident providers of funds with demonstrated portfolio mixes of equity and debt funds also will not make substantial changes to their equity to debt mix even though a lower company tax rate lowers the effective tax rate on equity but no change to debt.

Looking forward

Company income tax will continue to be an important component of the income tax system. Key roles include collecting revenue from income retained for further investment, collecting revenue earned by non-resident shareholders, and contributing information and integrity for the tax collector.

Policy for the taxation of capital income which effects decision on business investment should consider personal income taxation and withholding taxes on incomes sent to non-residents as well as company income tax. The non-neutral tax burdens under current bilateral tax agreements for different sources of non-resident income, and in particular debt interest, unfranked dividends, franked dividends, and capital gains, should be high on the list for reform. A more comprehensive approach with a focus on tax neutrality across the different saving and investment paths is required to achieve a more productive mix of the different funding options as well as to stimulate the aggregate level of business investment.

Recent Comments