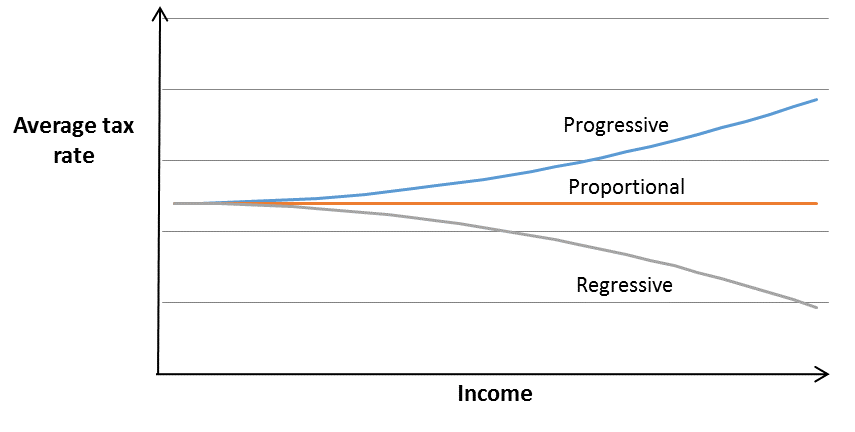

In simple terms, a progressive tax is a tax where the amount of tax paid as a proportion of income increases as income increases. A regressive tax is the opposite, where the amount of tax paid as a proportion of income decreases as income increases.

Figure 1: Progressive, proportional and regressive taxes

Source: Author’s Calculations

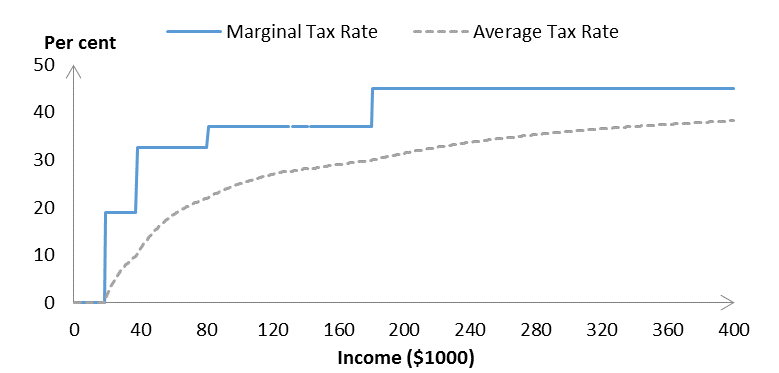

The most common example of a progressive tax is the personal income tax. As a person’s income increases, they enter into higher tax brackets. This means that they pay a higher tax rate on any additional income earned. As a result, the average tax rate increases as people earn more income. The following chart shows the marginal and average tax rates for the Australian income tax for 2014-15.

Figure 2: Marginal Versus Average Tax Rates in the Australian Income Tax System

Source: Author’s calculations (excluding the temporary budget repair levy and the Medicare levy)

While the income tax is progressive, many of Australia’s taxes are regressive. The GST is slightly regressive (with respect to income) as wealthier people spend less of their income on average than poorer people. So called ‘sin taxes’, such as the taxes placed on gambling, alcohol and tobacco tend to disproportionately affect those on low incomes. Many government charges, such as motor vehicle registration, are highly regressive.

Are progressive taxes better than regressive taxes?

All other things being equal, progressivity within a tax system is generally regarded as a desirable characteristic. However, it is usually quite difficult to determine whether any individual tax being progressive is a good or a bad thing. One issue is that redistribution is only one goal of the tax system, and any outcome must be compared with other goals, including efficiency and simplicity.

Another issue is that it is important to look at the progressivity of the tax system as a whole, and as a result it is dangerous to look at a single tax in isolation. For instance, it is often claimed that increasing the GST would make the tax system more regressive. This would be true if the GST was raised and the revenue used to fund a reduction in the income tax. However, an increase in the GST used to fund increased family payments would make the tax and transfer system more progressive.

Measurement of progressivity – the devil in the detail.

There isn’t a single measure of progressivity. In fact, there are a variety of options that need to be considered in order to estimate how progressive or regressive a tax is. The following section considers the four main decisions that need to be made in this process.

The first decision is to determine the economic incidence (as opposed to the legal incidence) of the tax. This process determines who bears the burden of the tax system. In general, it is difficult to determine exactly who bears the burden of a tax, as taxes placed on producers may be passed on to consumers, either in part or in full. In practice, simplifying rules of thumb are often used, such as assuming that all GST is borne by the final consumer, and all income and payroll tax is borne by the employee.

The second decision is to determine the appropriate unit base for comparison. This is generally done at either a household level or an individual level. This choice has important implications when looking at the impact of the tax and transfer system, as the tax system is largely based around the individual, while the transfer system is largely based around the household. Changes that decrease the tax paid by low income individuals will by definition be progressive when using individuals as the base, but if those low income individuals are the second or third earner in a wealthy household, then the same policy may increase regressivity when measured using the household as a base.

The third decision is to determine which definition of income is to be used. This could be the yearly income, or if the data is available, may look at income over a longer time period in order to smooth over short term fluctuations in income. Where an analysis is looking at data at the household level, it is also common to make an adjustment for the number of people residing in a household (as a family of 6 living on $100000 a year is less ‘well off’ than a family of 2 with the same income). An example of this is the ABS measure of Equivalised household income. Finally, in some cases, data on expenditure is used rather than income, which can be justified as a proxy for lifetime income, or a measure of ability to pay in its own right.

In many cases, the choice of individual or household as the base for comparison, and the choice of income definition will only make a minor change to the results. However, particular care needs to be taken when:

- Analysis involves retired people or students, who have very little measured income, but may have considerable wealth or expected future wealth and therefore may be considered reasonably well off.

- Analysis involves families with people taking time out of the labour force to care for young children. In this case there will be a significant amount of informal income that will not be apparent in the income data.

- Analysis involves unemployed people, particularly where people are unemployed for short periods of time. These people would report low income, but may be quite well off in general.

Where the results are sensitive to the assumptions used, it is common to provide the results under both sets of assumptions.

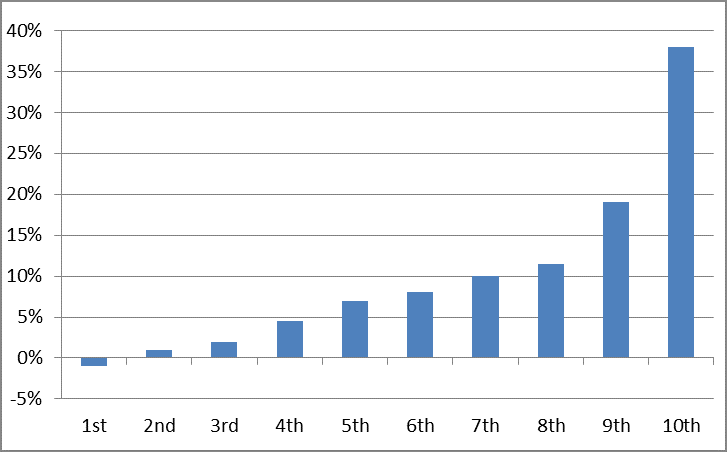

The final decision is to decide how to aggregate the results obtained in the analysis. In most cases, taxes won’t be strictly increasing or decreasing in income, and even in those cases, it is still of interest to know whether one tax is more progressive/regressive than another. One solution to this problem is to simply graph the results and allow readers to interpret them as they wish. This approach was taken in the following example looking at superannuation tax concessions, taken from page 56 of the TTPI stocktake report.

Figure 3: Proportion of superannuation tax concession received, by income decile

Source: The Murray Financial Systems Inquiry

Another approach is to use a summary measure, such as the change in the Gini coefficient, resulting from a policy. As a result of simplifying the information about the policy into a single number, such an approach must necessarily lose some information about the policy impact. However, the approach can be useful if it is important to express the results as a single number, such as if you wanted to compare the progressivity of tax systems in different countries.

Further Research

How should progressivity be measured? By the Tax Policy Centre

Tackling income inequality – The role of taxes and transfers. From the OECD Journal Economic Studies

What nation has the most progressive tax system, by Greg Mankiw

ABS Household Expenditure Survey

The Distributional Impact of State Taxes for South Australian Households, by Ben Phillips

A distributional analysis of the 2015-16 Federal Budget, By Ben Phillips

Recent Comments