Poverty rates are increasing in remote Australia, particularly in remote Indigenous communities which have among the highest poverty rates in the country. In 2021, Indigenous cash poverty rates in remote and very remote areas were extremely high at 41.0% and 57.1% respectively. Remote Indigenous poverty rates have been escalating alarmingly, increasing by 10.8 percentage points over the decade from 2011, driven by policy decisions such as the abolition of the Community Development Employment Projects (CDEP) scheme.

However, standard income-based poverty metrics like these fail to capture the impact of the elevated cost of living in remote communities on poverty. This oversight masks the severity of poverty among remote Indigenous populations, as inflated prices for food and other essentials in these areas deepen their financial hardship. Without adjusting for the higher costs in remote communities, conventional poverty rates offer a misleading picture, likely understating the true extent of poverty.

In this post, I estimate that remote Indigenous communities face higher prices for basic goods that are around 39% higher than those in major urban centres. This is due to the combination of small populations and geographical remoteness, which limits buying power and increases freight costs. A radical shift in the structure of Australia’s grocery industry to incorporate mechanisms like cross-subsidisation seems unlikely. So alternative methods are needed to mitigate remote poverty and ensure horizontal equity in the social security system.

The Remote Area Allowance

In 1984, the Hawke Labor Government legislated the Remote Area Allowance (RAA), a supplementary income support payment, with the objective of meeting “additional costs associated with residence in remote areas” for social security recipients. Eligibility for the RAA is determined based on the receipt of certain social security payments and residence within a designated remote area, determined using an antiquated geographical classification.

According to the Productivity Commission, the RAA does not address housing costs directly because “at the time the RAA was introduced, it was expected that any cost of living differentials in rental prices would mostly be compensated for through rental assistance rather than the RAA.”

However, the rate of RAA is very low. Currently, for a single age pensioner, the single person rate of $9.10 per week is just 1.7% of the age pension single rate of $541.30 per week, or for a single unemployed person just 2.4% of the jobseeker single rate of $374.60 per week. Those who are partnered receive somewhat less per person ($7.80 per week), with children receiving an additional $3.65 per week.

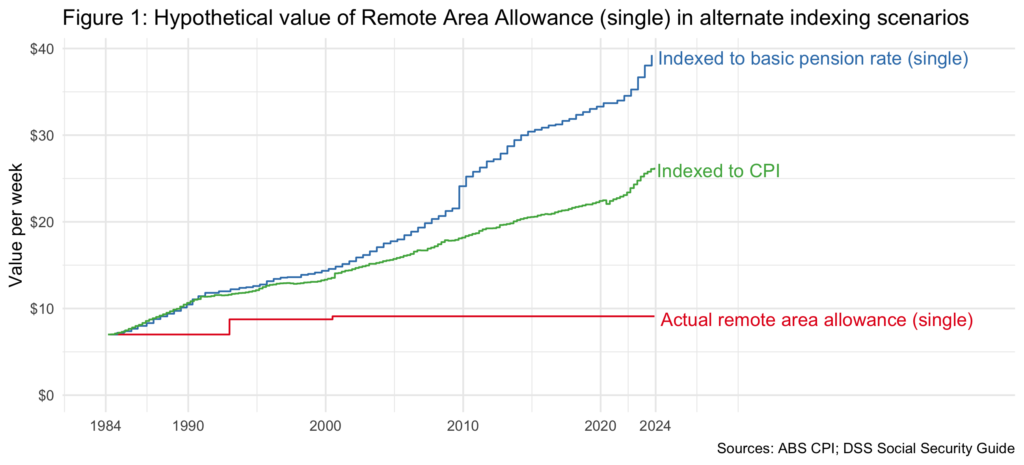

The RAA is not indexed and so falls in real value in line with inflation. Legislation has only increased its rate twice since 1984. As Figure 1 shows, if the RAA had been indexed to the consumer price index (CPI), then the single rate would now be $26.25 per week. If it had been indexed to the basic age pension rate, single rate would now be $39.25 per week.

In 2018, around 76,000 people received the RAA, the majority of whom lived in the Northern Territory, where one in five individuals over 15 years old receives the RAA. The remaining recipients mostly live in parts of Western Australia or Queensland. Half of RAA recipients live in regions marked by the highest levels of socioeconomic disadvantage, and two-thirds are Indigenous people.

Estimating an adequate rate of allowance

Setting aside the declining value of the RAA, it is unclear what an adequate amount for the supplement should be. It is unclear on what basis the initial magnitude of supplement was determined, although at the time of introduction, the Minister in his second reading speech, suggested that he would have legislated a more generous RAA had the government not been delivering a budget in the midst of a deep recession.

The principle of horizontal equity that underpins Commonwealth government resource distribution suggests that equal standards of living should be realisable for people who are eligible for the same income support payment. This principle manifests in the adjustment to social security payment rates depending on circumstances such as family composition. In Australia, a commitment to equalising standards of living across space is exemplified by horizontal fiscal equalisation, where the Commonwealth grants financial aid to states and territories to ensure service quality parity. Other examples include extra funding for rural hospitals through activity-based funding and Telstra’s Universal Service Obligation. Equal standards of living for recipients of a given payment, regardless of location, is a policy principle that should underpin future revisions to the RAA.

Little high-quality, comprehensive data exists by which living costs in remote Australia can be calculated. Two sorts of data are needed. The first relates to what remote-living consumers actually purchase. As has been noted by social scientists for decades, no official data on remote or Indigenous expenditure patterns exists. The second key piece of required data relates to the prices of goods and services in remote areas. No public, national data on this exist, although several collections do attempt to fill this gap in some jurisdictions and for some commodities.

Accordingly, here I attempt to sketch out an approximation of the cost of living on remote Indigenous communities relative to capital cities, based on available data (for details, see the note at the bottom). I focus on very remote Indigenous communities because they are a high proportion of the very remote population and have very low average incomes – and are now the primary recipients of the RAA.

Table 1 reports an estimate that the relative cost of living in remote Indigenous communities is 138.8% of capital cities. This 38.8% price differential in remote Indigenous communities can be applied to the rates of various social security payments to estimate rates of the RAA that would result in an equalisation of purchasing power between these locations and capital cities.

Table 1: Estimate of the relative cost of living in remote Indigenous communities, primarily in ‘very remote’ areas

| Remote community prices as percentage of urban prices | Estimated expenditure weight | |

| Food and drink | 138.8% | 44 |

| Transport | 144.1% | 17 |

| Electricity | 100.0% | 7 |

| Tobacco Products | 161.1% | 19 |

| Other goods and services | 119.4% | 13 |

| Total | 138.8% | 100 |

Table 2 provides a comparison of the extant RAA rates and a hypothetical adjustment necessary to harmonise living standards between social security recipients living in remote Indigenous communities and their counterparts in capital cities for five illustrative payments. An extremely substantial increase of $120-$300 per week is required to meet this goal.

Table 2: Remote Area Allowance rate required to equalise the estimated cost of remote Indigenous community living, payment rates as at 1 February 2024

| Base payment | Base payment details | Weekly base payment amount | Current weekly RAA amount | Weekly RAA supplement needed to equalise a 38.8% cost-of-living disparity |

| Youth Allowance (Other) | Single, no dependent children, aged 18 to 24, living away from home | $319.50 | $9.10 | $123.97 |

| Jobseeker Payment | Single, no dependent children, aged 22–54 years | $374.60 | $9.10 | $145.34 |

| Age Pension and Disability Support Pension | Single, no dependent children, aged 22 or over, including maximum pension supplement | $541.30 | $9.10 | $210.02 |

| Parenting Payment (Single) and Family Tax Benefit (Parts A & B) | Two dependent children aged 6 and 7, parent younger than the Age Pension age, including basic pension supplement | $761.74 | $16.40 | $295.56 |

The substantial nature of these required increases underscores the current allowance’s insufficiency in addressing the cost-of-living disparities. Although the estimations provided in Tables 1 and 2 are derived from incomplete datasets designed for other purposes, the profound economic disenfranchisement experienced by inhabitants of remote Indigenous communities is unequivocally clear.

Policy implications

The cost-of-living crisis is hitting residents of remote Australia particularly hard, given the existing high cost of basics like food and fuel. An intervention through the transfer system is urgently needed to ameliorate remote Indigenous poverty and ensure equity within the social security system.

To achieve this goal, an increase of $120 – $300 per week is needed (in addition to the changes needed to lift rates of Jobseeker and other payments nationally). Once increased, the uplifted RAA should also be indexed against the CPI. If this were introduced, the RAA rate should also be restructured to be calculated as a proportion of an existing payment, including a part payment, rather than as a flat rate for all eligible recipients. This latter change is needed to avoid the creation of a substantial ‘benefit cliff’ that might discourage some part-time workers from increasing their hours of work.

Finally, as this uplifted rate has been calculated for remote Indigenous communities and may not be applicable to areas such as Darwin, it should be applied within a new boundary designed to capture those social security recipients facing the highest living costs. This can be achieved possibly by using the Australian Bureau of Statistics’ ‘very remote’ area classification as suggested by the Productivity Commission, while retaining the current RAA rate within other existing RAA areas. Legislation to implement this change should be introduced as a matter of urgency.

An overhaul of the RAA should also trigger an in-depth review to consider other issues with the RAA. This includes:

- Appropriate geographical boundaries for eligibility;

- A potential tiered design of payment rates depending on area;

- The potential eligibility of recipients of Family Tax Benefits;

- Data collection to measure prices and household expenditure in remote areas.

These medium-term concerns with redesign are secondary to the pressing need for poverty alleviation in remote Indigenous communities. A substantial increase to the rate of the RAA provides a mechanism for remote poverty alleviation that could be quickly and effectively deployed. It is untenable that the most economically disadvantaged groups within Australia continue to bear the highest costs for food and other essential goods.

Technical note

Table 1 summarises ad hoc estimates of consumer prices and expenditure weights for remote Indigenous communities, from a range of sources. Expenditure weights are primarily derived from a household expenditure survey in two remote Indigenous communities, with an updated weight for weighting for tobacco products using 2018 sales data extracted from Thomas et al. (2021). Food prices refer to a national 2020 analysis by the Commonwealth Government. Differentials in transport costs are approximated by comparing the retail price of diesel in Northern Territory remote Indigenous communities with that in Darwin, as reported through MyFuelNT on 1 February 2024. Tobacco prices are based on a comparison of remote store data extracted from Thomas et al. (2021) with national data recorded by Scollo and Bayly (2023). The price differentials for ‘other goods and services’ are based on a conservative assumption that the price premium is half that reported for groceries.

Hi Francis,

Excellent article!

The cost of living is extraordinary for all Australians living in remote areas let alone those doing their shopping at Outback Stores.

It drives people out of their homes and kills off small towns.

It is far less safe for your health given shortage of doctors and allied health.

The RAA should be actively promoted to everyone living in remote areas. It clearly is being underutilised.

AND you are absolutely right. It is hammering the indigenous people. Where you’d place all these people below the poverty line would be quite an eye opener.

I’m sure people would love to provide data on their weekly shop.

The decimation of communities, health, social support and quality of life must be extreme.

I hope you have time and support to develop an urgent revolution.

Do you have any other research to recommend?

One should not forget that income and consumption taxes discriminate against remoter areas and promote metropolitanisation. The National Party opposed sales tax on freight for that reason but were muzzled when the more comprehensive GST replaced sales tax.

The only tax which seems to be neutral with respect to locational choice is a rent tax such as a simple rate on land values which reflect externalities of location captured in those land values.