In a recent publication in the Tax Institute’s Australian Tax Forum, we surveyed Australian tax practitioners to determine the extent they are accepting of selected recommendations following an independent review of the Tax Practitioners Board (TPB) covering the creation of a dynamic code of conduct with enhanced sanctions, investigations, and safe harbour protections.

Background

The Australian Government announced a review of the TPB and governing legislation in March 2019. The purpose of the review (see 1.41 to 1.43) are:

- a post-implementation review following the establishment of the TPB and governing legislation in 2009;

- consider the current regulatory framework of the tax profession and structure of the TPB; and,

- evaluate the suitability and effectiveness of the legislative and governance framework, the regulation of the sector, and recommend improvements.

Following a discussion paper in July 2019, the Independent Review of the TPB reported in October 2019. Following receipt of approximately 90 submissions, the review made 28 recommendations.

This followed with the Government responding in November 2020. In its response, the Government supported either in full, or in part, 20 of those recommendations. It rejected eight recommendations.

We canvased Australian tax practitioners through an online survey between July and October 2021 and asked whether they supported six selected recommendations covering the code of conduct, investigations, penalties, and the safe harbour provision.

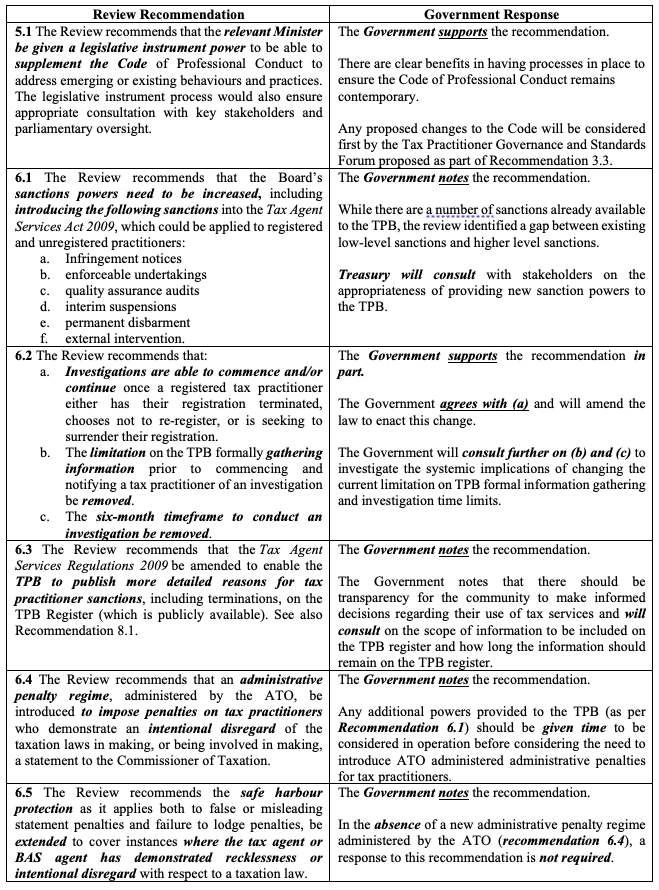

The selected review’s recommendations and government response to those recommendations are presented below:

Compiled from: Government’s response

Over the 14 weeks the survey was conducted, 145 participants clicked the link, however only 89 completed the survey in full while between 92 and 112 responded to the substantive survey questions.

Based on the 89 survey respondents, the majority of the tax practitioners were male (65%), aged over 50 years old (74%) and located either in Victoria or New South Wales (equal 25%). The majority were also sole practitioners (60%) and the majority spent 50% or more time on tax-related matters (84%).

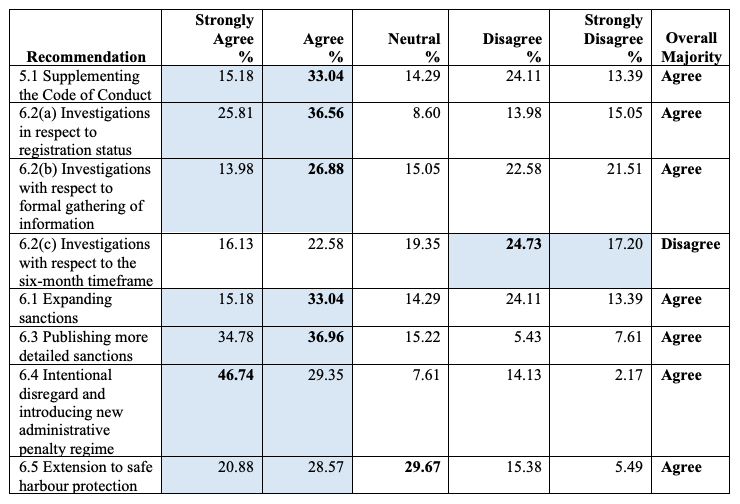

The following table presents the summary views from tax practitioners:

Summary of Findings

Source: Compiled from Devos et al.

Source: Compiled from Devos et al.

Supplementing the code of conduct

Overall, the majority of Australian tax practitioners supported Recommendation 5.1 – consistent with the Governments response.

However, this is a tempered response with several concerns raised, including the issue of government control and independence, as well as lack of expertise and the potential for political bias in placing such power in the hands of a minister.

Supplementing the Code should not be a “knee-jerk” reaction.

Investigations

Whilst Australian tax practitioners agreed with Recommendation 6.2(a), they disagreed with both 6.2(b) and 6.2(c). Again, this is consistent with the Government’s response.

Australian tax practitioners considered the act of deregistration should not of itself prevent a TPB investigation, although there was a need for having a valid reason to do so.

However, Australian tax practitioners had concerns over removing the limitation on gathering information and removing the six-month time frame for investigations.

For example, there were concerns around the right to know they were being investigated, with a caveat for criminality. Moreover, the investigations need to be efficient but adequate, have clear timeframes and avoid protracted investigations.

This reinforces the Government’s response that greater consultation was required on these aspects.

Sanctions

On the broader issue of sanctions, Australian tax practitioners generally support increasing sanctions under Recommendation 6.1 in contrast to the Government merely noting this recommendation and looking to seek further consultation.

Few reservations were noted by Australian tax practitioners.

Whilst Australian tax practitioners also supported overall publication of sanction details (Recommendation 6.3) and the administrative penalty regime (Recommendation 6.4), there were key caveats of note which highlights the need for further consultation as the Government noted.

In this regard, the devil would be in the detail in balancing transparency for public trust.

Safe harbour

Mixed results were identified for Recommendation 6.5; however, the majority position was supportive.

An unresolved issue was relevance of safe harbour per se and the interaction of both the practitioner and the taxpayer.

This warrants further in-depth consideration that goes beyond the review.

Contributing to consultation and reform

From a practical perspective, our research makes a critically important contribution by providing guidance on future tax policy and legislative amendments.

These findings support the agenda and role of the Tax Practitioner Governance and Standards Forum (TPGSF) through the provision of independent evidence of Australian tax practitioner perspectives.

The TPGSF itself was formed because of Recommendation 3.3 of the Review,

…to ensure that any significant proposals affecting tax practitioners… and the creation and ongoing application of the Charter of Tax Practitioner Governance, are made with appropriate consultation. – TPGSF

Of relevance, is the draft legislation on several recommendations, including Recommendation 5.1 on the legislative instrument power to supplement the code of conduct: Treasury Laws Amendment (Measures for Consultation) Bill 2022: Tax Practitioners Board of Review.

Likewise, our research reinforces several areas where further consultation is warranted, around the timeframes in conducting investigations and transparency in the TPB register.

The ATO will not be happy until every tax agent or lawyer giving any advice is required to get a favourable ruling from the ATO first.

Taxpayers should not be free to get truly independent legal advice.