Large projected fiscal burdens due to population ageing have caused many countries to increase the access age of their old age pensions. The average pensionable age in OECD countries is expected to increase to 65.5 years by 2050, with several countries looking at an access age of 70 years (OECD, 2015). An alternative government policy to limit expenditures on old age pension benefits is to means test (or better target) these payments to seniors with limited private means. Australia has extensive experience with means testing as it applies to most transfer payments, including the age pension (which has been means tested for most of its history, since commencing in 1909). This article outlines the design of means testing of Australia’s age pension, provides a comparison with targeted pensions in other countries and discusses the economic impacts of means tested pensions, drawing on Kudrna (2016).

Design of the age pension means test

Means testing of the Australian age pension incorporates both the income and asset tests. Each test includes the following parameters:

- Maximum benefit (that differs for single and couple pensioners)

- Disregard (income and asset thresholds up to which the maximum benefit is paid)

- Taper (rate at which the pension benefit is withdrawn).

The pension benefit paid to an eligible individual or household is then determined by either the income or asset test that results in a lower pension amount. Specifically, under the income test, a single pensioner with annual private income of up to $4,212 (the income disregard) receives the maximum annual benefit of $22,542.[1] There is an additional disregard of $6,500 for labour income to encourage labour supply of older Australians. Beyond the disregard, the maximum pension is reduced at the taper of 50% for every extra dollar of assessable income.

The asset test also distinguishes between homeowners and renters, with the asset disregard being higher for renters who have a greater need to save. Beyond the disregard, the maximum annual pension is currently reduced by $39 for every additional $1,000 of assessable assets. Note that the Australian government has recently legislated to tighten the asset test by doubling the asset taper from July 2017 onwards.

At present, the income test applies to most age pensioners, because the asset test has a large disregard. However, because the asset test has a steeper taper, it affects those pensioners with higher financial wealth. Nevertheless, the means test is quite generous – in addition to their home (that is exempt from means testing), a couple can hold more than $1.1 million in combined financial assets and still receive some pension.

Comparison with means test pensions in other countries

Means tested pensions are not uncommon and around a third of OECD countries have some form of means tested pensions (OECD, 2015). Whereas the coverage by these pensions is less than 20% in most countries, the coverage of the age-eligible population in Australia and Denmark is almost 80% and 90%, respectively. As for the means testing, in almost all countries the test is against private income or pension income. In this regard, the Australian age pension is unusual as it applies the so-called broad means test that includes both the income and asset tests.

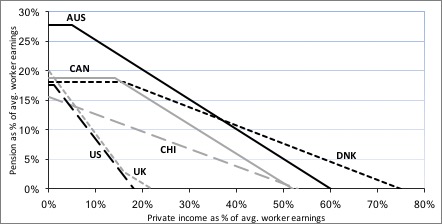

Figure 1 compares means tested public pensions (under income test) in selected OECD countries where targeted pensions cover a large proportion of the older population (e.g. Denmark with almost 90% coverage). It shows that the Australian pension benefit is more generous (with the maximum single pension rate at 27.7% of full time male gross wages) than means tested pensions in other OECD countries. But the design of the income test of the Australian age pension features a more aggressive taper than seen in many of these countries.

Figure 1: Means tested public pensions in selected OECD countries, 2012-2014

Notes: Average worker earnings are represented by full-time adult total gross wages; pensions are based on the income test and for single pensioners. Source: Chomik et al. (2015).

Economic effects of means tested pensions

Published research by Kudrna (2016) on means testing public pensions and other CEPAR publications on this topic (e.g. Chomik et al., 2015) highlight important trade-offs between high effective marginal tax rates (EMTRs) due to means testing, the number of people affected by means testing, and other explicit taxes needed to fund means tested pensions.

Means testing is often criticised for the high EMTRs that a withdrawal of the pension benefit generates for some seniors (which for a narrow range of income almost reach 80% – see Ingles and Plunkett, 2016). However, one needs to account for other two key points. First, only some people face the “taper” – the poor receive the full pension, no matter their behaviour; and the rich receive nothing, no matter what they do. In fact, while a more aggressive taper generates higher EMTRs, it affects a smaller proportion of the eligible population than a shallower taper. Second, the tax on workers to finance a means-tested program is much lower than in countries with a universal pension program.

Findings by Kudrna (2016) – who used an overlapping generations (OLG) model for the Australian economy to examine the economy-wide implications of changes to the means test and access age of the age pension – include the following main conclusions.

- Tightening the pension means test by increasing the taper at which the pension is withdrawn has positive impacts on long run welfare and macroeconomic variables, including per capita labour supply, domestic assets and output. This is due to incentives to work and save more, resulting from reduced pension payments and reduced income tax rates required to finance lower pension expenditures.

- Increasing the pension taper gradually over the next decade is shown to more than halve the losses attained by some current elderly cohorts, as this gradual policy with announcement effects allow elderly households to at least partially adjust their behaviour to mitigate the welfare losses from pension cuts.

- Compared to increasing the pension access age, tightening the means test leads to more equitable distributional welfare effects. Note that while increasing the access age impacts negatively especially low-income households (who have to wait extra years to become eligible for the pension), the taper policy has no direct impact on the welfare of low-income households as they receive the maximum pension regardless of the taper.

- Accounting for a more demographic ageing environment with increased longevity and higher population shares of elderly cohorts further strengthens the case for means testing of public pensions. This is due an automatic adjustment mechanism that means tested pensions provide to mitigate increasing fiscal costs driven by population ageing, thus allowing for significantly lower income tax rates needed to support these pensions compared to tax rates needed to fund universal pensions.

The research project that deals with the optimal design of means tested public pensions for an ageing demographic is currently being undertaken at the ARC Centre of Excellence in Population Ageing Research (CEPAR) by George Kudrna, Chung Tran and Alan Woodland.

[1] Notice that all the figures presented for the income and asset tests are as of September 2015 and that the maximum annual pension for each of a pensioner couple is $16,991 – about 75% of the maximum single rate pension.

Recent Comments