Published by the Huffington Post, Tuesday 9 February

Poor strategy, weak leadership, a squandered opportunity? The tax reform debacle was all of those things.

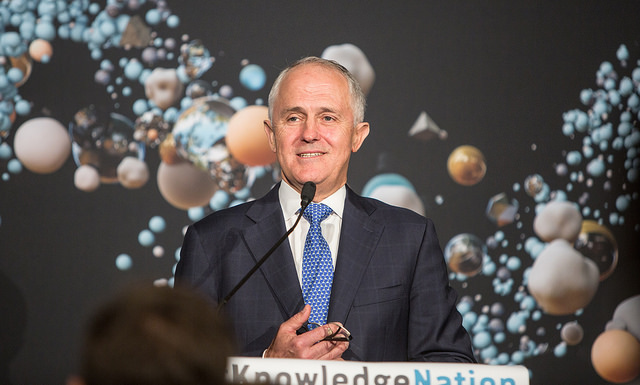

You can reasonably ask what on earth were Malcom Turnbull and Scott Morrison thinking they were doing when it came to tax reform.

The arrival of Turnbull brought forth an enormous sigh of relief, right across the electorate. He looked and sounded like a leader. He certainly didn’t make us “cringe” when he attended international meetings and important occasions. He seemed willing to address the key issues, and seemed committed to restoring growth, confidence and social cohesion.

He has been very eloquent. Expectations have mounted. But he seems to lack a clear strategy, and he has been doing very little actual governing.

The idea of inviting all to “put their tax options on the table”, without a realistic assessment of our economic circumstances and prospects, and without an overarching fiscal strategy, simply meant expectations ran wild, with the sum of “preferred options” soon far exceeding any government’s capacity to deliver.

There is simply not enough revenue, even with a 15 percent GST, to fund the handing back of bracket creep, with net personal tax cuts, a significant reduction in the corporate tax rate, along with adequate direct compensation to benefit recipients, while funding the medium term demands of the States for schools and hospitals, let alone completing the NDIS, the NBN and a host of infrastructure projects.

And this would probably still be the case if GST revenue was augmented by a reduction in superannuation tax concessions, a paring back of negative gearing, a genuine crack down on multinationals, a reduction of capital gains tax concessions, and so on.

These are all the key elements “expected” of tax “reform”. But even if all this had been welded together as a “package”, many would still have been disappointed with the outcomes. The Government’s strategy of encouraging all options, without any leadership, or specification of priorities, was always going to fail, and risk raising broader concerns about overall lack of leadership, strategy, and commitment.

The community was allowed to see tax reform as something of a “magic pudding”, where every group could have what they wanted, in a brave new world of growth and contentment.

But, once again, short-term political considerations have neutered genuine tax reform. Turnbull has bowed to a weak attack by the Opposition, and some squeaking form his own backbench, without giving reform a genuine chance.

They made no attempt to mount a genuine reform agenda. That would require three key stages:

- First — to get the community to understand and accept the need for tax reform, and its urgency, with the tax system having been left to drift for years.

- Second — to methodically lay out the options, various tax packages etc, to stimulate debate recognising limitations and trade-offs.

- Third — the Government should spell out its preferred option/package and to go out to explain it, and fight for it.

Worse still, not only was such a strategy absent, but Morrison, in particular, kept claiming the undeliverable, namely that he could “fix” the Budget by further cutting expenditure, while reforming tax, with no increase in the overall tax burden.

While expenditure can always be trimmed as government is made more efficient, the reality is that government spending sits at about 26 percent of GDP, while revenue is a mere 23 percent of GNP — a gap of some $45 billion — with revenue prospects being consistently scaled back by global events, our weak growth, poor wages growth, weakening corporate profitability, low inflation, and so on.

The overall tax burden will need to increase if governments are to meet the medium-term expenditure aspirations of the community.

This is a reality that must be accepted as a foundation for any realistic tax reform debate.

Turnbull ditched the GST increase, as a central element of a tax reform package, on the grounds that he couldn’t see that it would stimulate growth. Be sure of one thing — doing little or nothing in terms of genuine tax reform, over and over, and expecting better growth results, comes very close to confirming Einstein’s definition of insanity.

Of course, GST is but one element of genuine tax reform, as is tax reform but one element of an overarching economic strategy to boost national productivity.

With our economy struggling to make an effective and sustainable transition from a resources boom, to whatever, in an increasingly difficult global growth environment, the challenge for the Turnbull Government in the forthcoming Budget is to spell out the detail of this overarching strategy, and to delineate a broad-based policy reform agenda, including tax, but also IR, education and training, innovation/technology, and so on, to achieve it.

Clearly, Turnbull is focused on winning the next election by talking a lot, but doing as little as possible, so as to minimise any electoral disenchantment, so as to preserve his popularity.

This minimalist strategy will surely get him re-elected, with Shorten as his best asset, but without the essential mandate — against a still-hostile Senate — with which he could hope to provide genuine leadership and reform.

Recent Comments