Classic “pork barrel” theory, as originally developed by Weingast et al (1981), argues that larger legislatures lead to increased spending, especially on capital, and the implementation of projects that are ‘too large’. In this context, a growing number of legislators exacerbates the fiscal commons problem, whereby individual members seek to target project benefits to their home districts, but the project costs are funded from a common pool of cross-district resources.

As the number of legislators rises, any given councilor absorbs a smaller share of an additional project’s tax costs, leading to higher demand for increased capital spending and inefficiently large projects, so the theory goes.

How does pork barrel theory hold up in sub-national Indonesia? There are good reasons to think that it may not work well in the Indonesian environment. First, local government jurisdictions comprise voting districts with multiple council members, not single legislators, as assumed by traditional theory. In this context, it is not clear why a councilor would obsessively focus on returning capital projects to his or her home district, which includes other legislators: he or she may have to share credit with possible electoral opponents among voters for doing so.

The existence of multiple member districts would seem to generally diminish the demand for home-based capital projects. Second, and perhaps more importantly, local tax instruments and rates are quite constrained by national legislation. Tax revenue cannot be expected to inevitably rise to finance increased councilor demand for capital spending, as the theory assumes. So, even if a rise in the number of legislators were to stimulate more demand for home-based projects, it is very unlikely that such demand could be funded from local own-sources, either directly or indirectly to repay project loans.

These differences cast doubt on the relevance of pork barrel models in sub-national Indonesia. An increase in the number of councilors cannot be assumed to automatically result in an increase in demand for capital projects, everywhere and all the time. Hence, the presumption that any such rise in demand necessarily results in the financing and implementation of projects is very doubtful.

A different approach: problem of constrained decision-making

I suggest that a different theoretical approach may be more suitable to the Indonesian case. Borrowing from Coate and Knight (2011), I assume that elected council members and mayors have possibly dissimilar preferences regarding spending, service delivery, and taxation, and that such differences constrain decision-making. Furthermore, I hypothesize that reaching agreement on these issues depends on the number of decision-makers involved. I presume that an increasing number of legislators on the council restrains timely and sound decision-making.

I expect therefore that a growing number of councilors will lead to reduced total capital spending and constrained public service access. This is simply because necessary and joint mayor-council decisions related to efficient project spending and service delivery are not arrived at in a timely fashion and/or are poorly made.

On the other hand, local governments and parliaments have quite restricted decision-making authority over locally generated revenues. The local tax that mobilizes most revenue is that on personal and business electricity consumption. The latter is administered by the National Electricity Agency (PLN), not the district government. Other allowable tax instruments and maximum tax rates (which are routinely adopted by most local governments) are both fixed in national law.

Constrained policy choices limit mayor and councilor capacity to independently affect local own-source revenues, in any manner, even if they were able to reach agreement. I anticipate, therefore, that an increase in the number of local legislators will have no effect on the generation of local tax revenue, all else equal.

Residents pay the same taxes, but receive fewer services

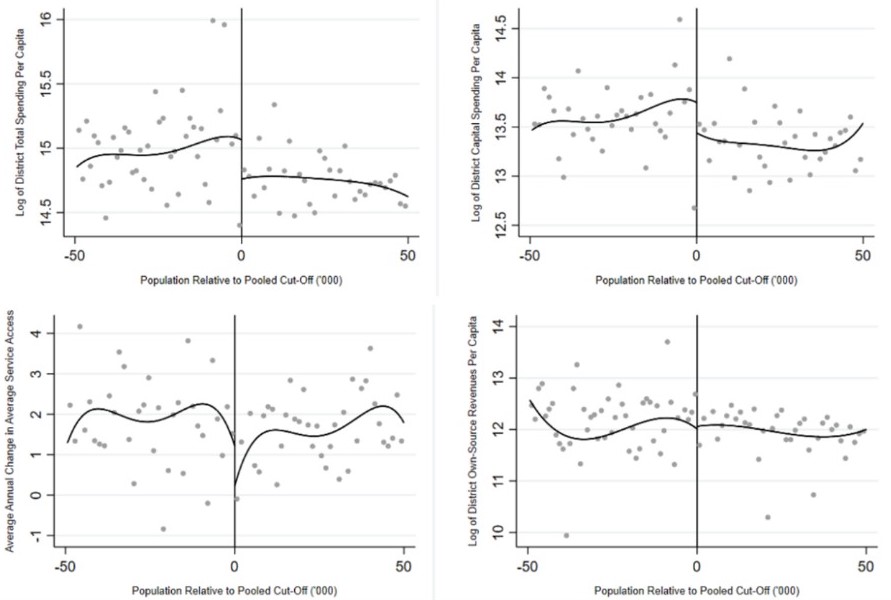

I test the above hypotheses on local legislative elections in 2004 and 2009 using a quasi-experimental research method — regression discontinuity design (RDD). I find that an increase in five legislators (the standard increase in council size in moving from one size class to another) on the local legislature leads to a decrease in total and capital spending, a decline in service access, and has no impact on local own-source revenue generation, as my theory predicts should be the case.

These outcomes are nicely illustrated in Figure 1, which shows the standard RDD plots, where observations to the right of the vertical line (the cut-off) represent an increase in the number of legislators (treatment) and those to the left represent no increase in the number of councilors (control).

(Click to enlarge)

Figure 1: RD plots for district spending, service access, and taxation

The formal treatment effects regressions imply that an increase of five local councilors causes a 17 per cent decline in total district spending, a 22 per cent decrease in capital spending, a nearly one percentage point reduction in citizen access to public services, and no effect on local taxation. Table 1 presents the details.

Table 1: Legislature size impact on district spending, service access, and own-source revenues

Note: Tot Obs is the total number of observations. Bandwidths are thousands of persons. Obs Left and Obs Right are the effective numbers of observations used in estimation. τ is the conventional estimated treatment effect and ρ is the robust ρ value. All fiscal variables are measured in constant 2010 terms.

Taken together, the empirical results suggest a decline in local efficiency: residents pay the same amount in taxes but receive fewer services. The findings of my investigation contradict theoretical predictions and recent empirical results from other research. Apparently, what drives results in Indonesia is not pork barrel but the number of cooks in the kitchen.

Policy consequences

One implication of the research, specifically for Indonesia, is that government may wish to consider decreasing the size of local councils (or at least not increasing them as was done prior to the 2009 elections and as is now being discussed again). Smaller council sizes would, in theory, encourage local governments to spend more, especially on capital, and improve service access for citizens.

The adoption of such a policy stance seems unlikely, however, since it would challenge significant political interests associated with holding positions of power at the local level. But if such a strategy is not embraced, average legislature size will persist in rising, mechanically along with population growth, and as a result fiscal and service outcomes will continue to suffer.

Further reading

Lewis, B D. 2019. Legislature size, local government expenditure and taxation, and public service access in Indonesia. Studies in Comparative International Development, 54(2): 274-298.

Blog articles on Indonesia

Minimising Potential Tax Avoidance by Strengthening Transfer Pricing Policy in Indonesia, by Maria RUD Tambunan, Haula Rosidiana and Edi Slamet Irianto (11 February 2020)

Income Contingent Loans Can Provide Equal Access to Higher Education in Indonesia, by Elza Elmira and Daniel Suryadarma (18 November 2019)

Do Tax Structures Affect Indonesia’s Economic Growth?, by Heru Iswahyudi (4 November 2019)

Recent Comments