Tax theorists recognise two problems with a conventional capital income tax. One is that it creates a higher effective tax rate on saved income, and this rate rises over time. This has been referred to as the ‘double taxation’ of saving.

Suppose, for example, that someone has a choice between an apple and an orange in year 1, or two apples and two oranges in year 10 (a 7 per cent real return). A 50 per cent consumption tax would reduce all these options in strict proportion – that is, to half a fruit now or a whole fruit in year 10, and this minimises the efficiency loss from taxation. The reward for waiting is still 7 per cent a year, which is the underlying yield on the investment.

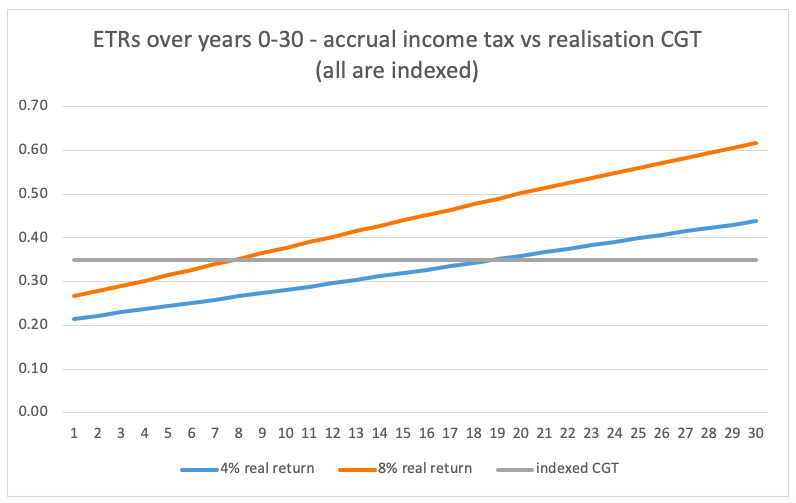

An income tax reduces the year 10 options by well over half, and thus has undesirable relative price effects. This is one reason tax theorists have been attracted to consumption taxation or to concessional taxation of superannuation savings (the Henry Tax Review is an example).The effective tax rate calculation in Figure 1 below compares actual outcomes with a ‘no tax’ outcome at a period of up to 30 years.

Figure 1. Change in effective tax rates (ETRs) over time, single savings event, 35 per cent tax

Source: Author calculations. A 35 per cent tax rate corresponds to .35 on the vertical axis. ‘Indexed CGT’ is on realisation; accrual CGT is the same outcome as an income tax. A zero tax would be a horizontal line at 0.00.

The second problem is that many forms of investment yield capital gains as well as income, and it is quite difficult to tax the two streams at the same effective rate. This is because the deferral of tax under the capital gains tax reduces the effective tax rate, and this compensates for the tendency for the effective rate to rise over time (as shown by the flat ETR line for an indexed capital gains tax – CGT – in Figure 1). So investors try to dress capital income up as capital gain.

Now this could be addressed by taxing capital gains as ordinary income – that is, on annual accrual. This is feasible for shares, somewhat less easy for property and very difficult for closely held small companies. But why seek this outcome anyway?Maybe it is better to treat all capital income in the same manner as deferred capital gain and thereby address the ‘double taxation’ concerns.

The Z-tax

This is the intuition underlying the Z-tax. When someone saves, they are allocated a Z-tax credit which attaches to the saving and is updated each year by an escalation factor, which can be the inflation rate (called the ZT-IT) or the bond rate (called the ZT – rate of return allowance or RRA) or the ‘normal’ return (ZT-ET), which is the only fully neutral system in that the ETR on savings is zero. The RRA was proposed by the Mirrlees Review as a compromise between the arguments for not taxing savings yield and the arguments that the wealthy should pay more tax. The RRA taxes ‘economic rents’ – returns in excess of the risk-free rate.

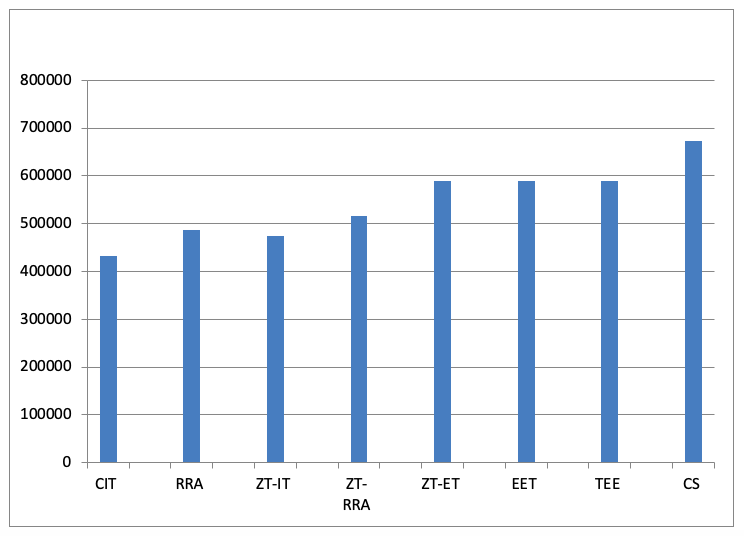

When savings are run down, tax is applicable at the full rate, but is offset by the amount of the uplifted Z-tax rebate. Modelling shows that this produces quite reasonable results (Figure 2), comparable to the RRA. However, they are typically not as generous as the EET system favoured by many tax theorists, whereby savings and earnings are exempt and only drawdowns are taxed.

Figure 2. Net retirement lump sums at 40 years under various tax options, earnings equal average weekly ordinary time earnings in 2015, tax rate 35 per cent

Source: Modelling by author. CS refers to the current retirement tax system in Australia. The CS and CIT base is indexed. In all tax systems except CS the tax rate is 35 per cent. EET and TEE are post-paid and pre-paid expenditure taxes, respectively. The uplift rate for the ZT-ET (expenditure tax) is 4 per cent real, the same as the assumed net return in the superannuation system.

Technically, the Z-tax is a modified cash flow consumption tax (EET), but unlike this tax most of the revenue is collected upfront so it is less costly, and eases issues with departing and arriving residents. The ZT also deals with the issue of ‘lock in’, whereby it becomes costly to dispose of assets having built-in capital gains. Disposal of assets is untaxed so long as the proceeds are rolled over within the ZT ‘box’.

Figure 2 also shows that the ZT uplift rate can be designed to mimic the outcome of the RRA.

If the Z-tax applied across the board, it would more heavily tax superannuation and investment property, and more lightly tax other forms of savings. Overall revenue from taxing capital might be around the same as currently, but the efficiency costs would be much less. This would allow the income tax to rival the efficiency of other broad taxes, such as the uniform value added or payroll taxes.

The ZT could also apply to the owner-housing sector, which could double the revenue and allow the abolition of other more economically costly taxes, such as stamp duty. However, the arguments for doing this are the same under the income tax, so I will not expand upon this point except to note that the ZT, with its built-in rollover relief, is easier to apply than a capital gains tax. There would ideally be a deemed drawdown at death and taxation of imputed rent, so the politics of this is very difficult.

With an individual Z-tax, there may not be a need for a separate corporate income tax. This tax now acts as a pre-collector for the personal tax and reduces avoidance, for example by re-investing profits. This is not needed under the Z-tax, which fully allows for deferral until ultimate consumption. There may still be a need to tax economic rents arising from the activities of foreign owned corporates, and in a separate working paper I have proposed a corporate Z-tax as a way of doing this.

This article is based on a new Working Paper, Taxing capital income and the Z-tax solution, from the Tax and Transfer Policy Institute, ANU.

Further reading

Improving Cash Flow Corporate Taxation and the Z-Tax Approach, by David Ingles (10 September 2019)

Recent Comments