Taxes on personal income prompt behavioural responses as individuals seek to maximise their well-being, often by minimising their tax burden.

The elasticity of taxable income (ETI) measures how individuals adjust their behaviour in response to changes in tax rates. The ETI is a critical parameter to inform the design of the tax system. It is not a “deep” parameter, however. It is determined by the tax system and can change with the tax system. It is thus important to have country-specific estimates of the ETI.

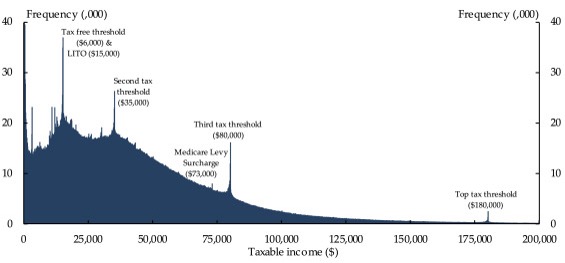

Methods for analysing bunching, developed in the early 2010s and supported by administrative data, provide reliable estimates of the ETI under some simple assumptions that are likely to be met in our set-up. These methods involve measuring kinks created by a progressive tax schedule, which create incentives for individuals to adjust their reported, taxable income to stay below thresholds where marginal tax rates are higher above the threshold. This creates bunching in the distribution of taxable income at those thresholds.

In a recently published study, we apply bunching methods to estimate the ETI in Australia. Previously, bunching analysis was primarily conducted in the United States, Denmark and Sweden, due to data availability. Prior to our study, there had been limited attempts to estimate the ETI in Australia through bunching methods, focusing on specific components of the income tax system, including the Higher Education Contribution Scheme (HECS) and the Medicare Levy Surcharge.

In Australia, we have a progressive income tax system, and several features of the Australian tax system make it an interesting case. First, the tax system is comprehensive, including all sources of income (both labour and capital), which minimises issues related to income classification under dual or hybrid tax systems. Second, there are no complex interactions between state and federal government taxes, as personal income taxes are solely levied by the Federal Government.

Third, the Australian system stands out for allowing a wide range of deductions, making it relatively easy for individuals to manipulate their taxable income. Finally, the general structure of the Australian tax system has remained stable for the past two decades, providing individuals with the opportunity to understand and gain familiarity with the system.

We use the universe of administrative tax data from the Australian Taxation Office. These data include all individuals who lodged a tax return from 2000 to 2018, along with demographic information such as gender, age and marital status. Our analysis focuses on individuals aged 20 to 65 residing in Australia, providing a sample size exceeding 189 million observations across all years.

To estimate the elasticity of taxable income across all tax thresholds and years in our dataset, as well as across various demographic and economic groups, we employ bunching methods proposed by Emmanuel Saez (2010) and Raj Chetty et al. (2011).

Bunching manifests at all thresholds

In the paper, we present the distribution of taxable income for the year 2010, which marks the midpoint of our study period. The distributions for the remaining years are provided in the paper Appendix.

Our empirical analysis reveals several key findings.

First, in contrast to studies conducted in other countries, we find evidence of significant bunching at all income thresholds of the tax schedule (see Figure 1). There is also a considerable variation in the estimated ETI across different income levels, ranging from 0.03 to 0.16.

Figure 1: Distribution of taxable income 2010

Second, ETIs (and bunching) are considerably lower for wage and salary earners than for self-employed individuals and taxpayers who use trusts. This disparity primarily arises from the ability to defer income realisation across time periods and use trust funds for income splitting within and across households.

In our classification, individuals are categorised as “self-employed” if they report business income (or losses), net trust or partnership income, or if dividends exceed 20 % of their wages and salary income. The lack of identification of self-employed individuals in the Australian tax administration system and tax returns requires the construction of a proxy variable.

Third, among self-employed individuals, we observe larger ETIs for women compared to men, particularly during typical child-bearing years. This suggests that women may receive trust distributions from family-controlled trusts, which provide the flexibility to adjust the distribution amounts to stay below key income thresholds. We also find that married women exhibit larger ETIs than single men, as these groups are more responsive to changes in marginal tax rates. Additionally, the ETI for women with children increases with the number of children.

Fourth, our analysis indicates that the increased use of data matching and pre-filling by tax authorities preceded a decline in ETIs. This finding suggests that improvements in tax administration and compliance practices have an impact on the ETI.

What this means for policy

Our findings underscore the importance of considering the overall structure of the tax system during tax reform initiatives. They also highlight how administrative features of the tax system play a crucial role in understanding potential behavioural responses.

Additionally, our research suggests that ETI estimates derived from one jurisdiction may not accurately predict responses in another jurisdiction, even if they share similar tax rates. Therefore, it is essential to conduct research that produces country-specific estimates. Attempting to apply elasticity estimates from one country to design tax systems in another country is likely to produce external validity problems.

Further research is needed to examine tax sheltering behaviours and the opportunities for tax avoidance within the Australian tax system. Of particular interest is examining how taxable income interacts with tax sheltering practices among family members through the use of trusts and closely held businesses.

Dear me, I hope no bright Treasury official decides this bunching is all due to women having babies to replace the taxpaying population! Of course, the real problem is bad tax design in the first place. A sensible income tax system would allow unlimited income transfers and tax and means test accordingly. We should be delighted if taxpayers support other people voluntarily and such persons do not end up dependent on tax financed transfer payments.

PS Re “Third, the Australian system stands out for allowing a wide range of deductions, making it relatively easy for individuals to manipulate their taxable income”

Not sure many taxpayers or their lawyers would agree with that. Concessional deductions pretty much got wiped out in the Hayden Budget of 1974.