For a brief period when the JobSeeker unemployment benefit was increased to $550 per week and conditionality was relaxed, Australians had access to a type of Basic Income.

The results were impressive. Billions in macroeconomic stimulus and hundreds of thousands of Australians kept out of poverty.

Recent research has documented the impact of the boosted JobSeeker payment on income poverty levels and the lived experience of welfare recipients.

Scenario modelling by Phillips, Gray and Biddle (2020) found that individuals receiving ‘Newstart/Youth Allowance are estimated to have experienced the largest reduction in household poverty gaps, from a pre-COVID average of $6,201 per year to just $241 per year’ with poverty rates plunging from 67 per cent to 7 per cent for this cohort.

But this unplanned experiment is drawing to a close. Conditionality has been reinstated and the payment rate progressively reduced in step with the Federal Government’s stated intention to end the Coronavirus supplement in March.

Spies-Butcher has pointed to the irony of being able to ‘somehow…lift thousands out of poverty’ at the height of the pandemic while ‘as the economy grows and prosperity is restored, so too is poverty’.

But the pandemic has clearly shown that governments and societies have choices when it comes to social protection.

Basic Income

One option that has gained currency in policy circles and public debate in recent years is Basic Income (BI) or Universal Basic Income (UBI).

The Basic Income Earth Network defines Basic Income as ‘a periodic cash payment unconditionally delivered to all on an individual basis, without means-test or work requirement’. But the idea also encompasses a negative income tax where payments are only made to individuals below a specified income threshold.

A recent YouGov survey of Australian attitudes found that 58 per cent of respondents would support ‘a Guaranteed Living Wage or a Universal Basic Income’ with 19 per cent opposed. And 50 per cent agreed ‘we should provide unconditional income support to those out of work’ compared to 25 per cent opposed.

These results offer some encouragement to those interested in more universal and less conditional forms of social protection as a policy option for Australia.

We contributed to this evolving debate in ‘Between universalism and targeting: Exploring policy pathways for an Australian Basic Income’ published in the Economic and Labour Relations Review (full text available here).

Our research

Our first aim was to enumerate a set of principles that would underpin a model of Basic Income that is sensitive to the institutional logics of the Australian welfare state. Second, we modelled the fiscal and distributional impacts of an Australian Basic Income, highlighting particular policy tradeoffs in such a shift.

Our model is structured around the principle of ‘affluence testing’ in which ‘income-testing is primarily used to limit access by the better off’, rather than targeting payments only to the poor. In practice this means reducing taper rates, making more people eligible for part-payments.

We suggest this approach would move the Australian social transfer system in a more universal direction while containing the fiscal cost—and associated fiscal churn—of a UBI-style payment that would pay all adults the same Basic Income amount. Affluence testing encompasses a focus on both equity and efficiency.

Next we specified four subsidiary principles that reflect the logic of integrating tax and welfare systems via effective marginal tax rates (EMTRs) and acknowledge existing institutional arrangements as the starting point for reform. These are:

- EMTRs should only increase with income (progressivity of incentives);

- High-income earners should receive no net benefit from moves towards universalism (fiscal efficiency);

- No below median income earner should be left worse off (in other words, have a lower net income for any given market income) (equity);

- The current tax scale should be largely taken as given (path dependency).

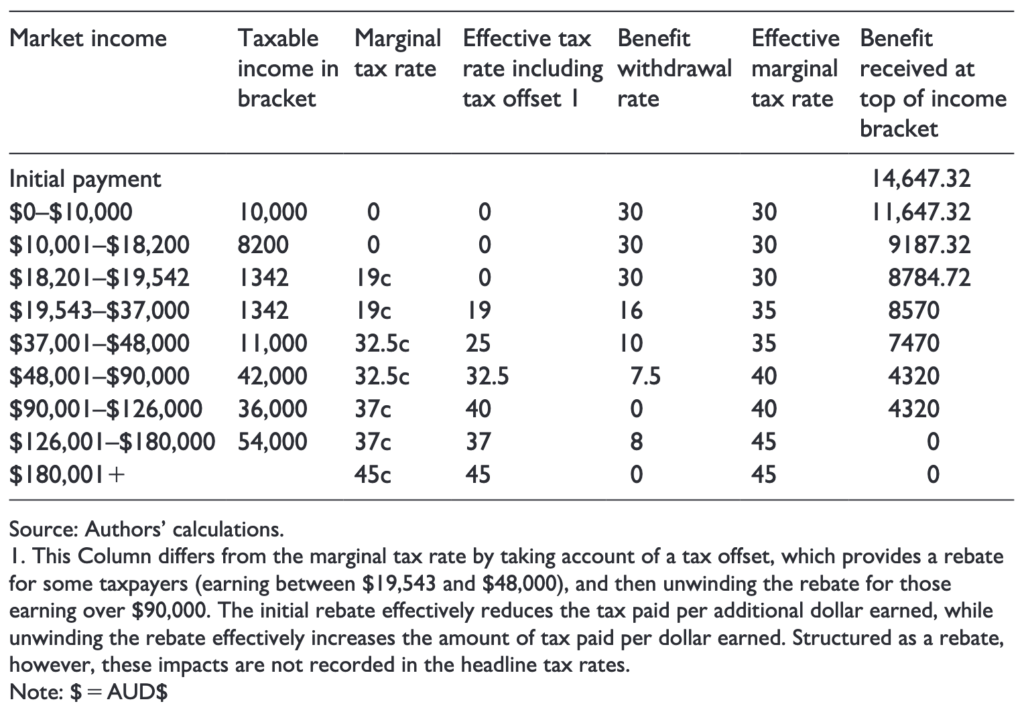

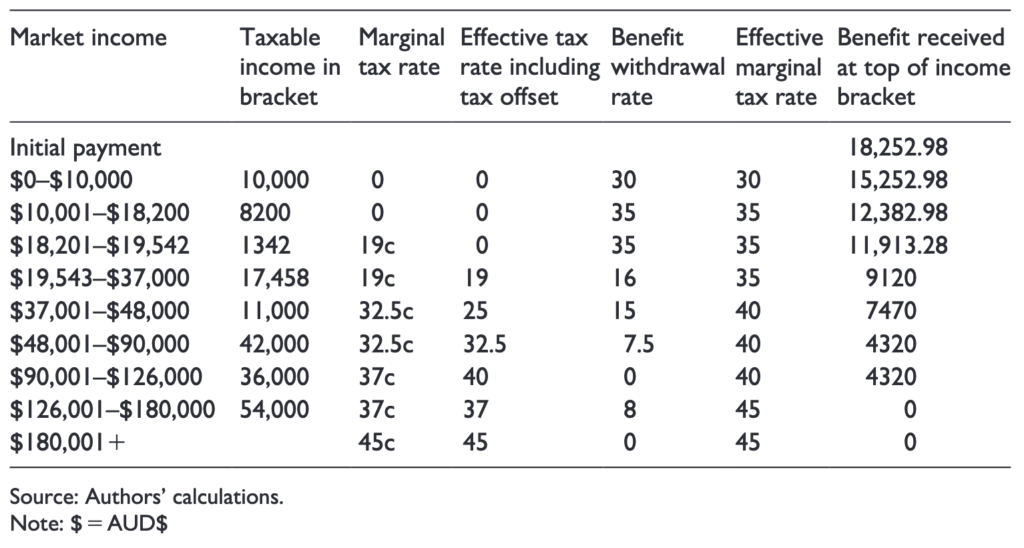

Based on these principles we modelled two Basic Income scenarios for Australia based on pre-COVID payment levels. Model 1 has a base rate of the Newstart unemployment benefit ($14,647.32 per annum). Model 2 has a base rate of Newstart plus $75 per week ($18,252.98 per annum) in line with pre-COVID stakeholder campaigns to ‘Raise the Rate’.

Adults age 18 until pension age would be eligible for the Basic Income payment without being subjected to asset tests or work activity testing. The base rate is gradually tapered as market incomes increase (See Tables 1 and 2).

Table 1: Affluence-tested Basic Income payment Model 1, Newstart.

Table 2: Affluence-tested Basic Income payment Model 2, Newstart + $75pw.

Individuals receiving a higher payment, such as the Disability Support Pension, would remain on their existing benefit in line with much international Basic Income literature. The retirement incomes system is left unchanged.

The fiscal and distributional impacts of both payment levels are estimated using the ANU’s PolicyMod model of Australia’s tax and transfer system.

Findings

In terms of fiscal impact, the estimated annual net cost of Model 1 is $103.45 billion, and the annual net cost for the more generous Model 2 is $126.1 billion. While clearly significant sums, meeting the additional cost would only require an increase in Australia’s tax-to-GDP ratio (currently 27.8 per cent across all levels of government) to around the OECD average of 34.2 percent.

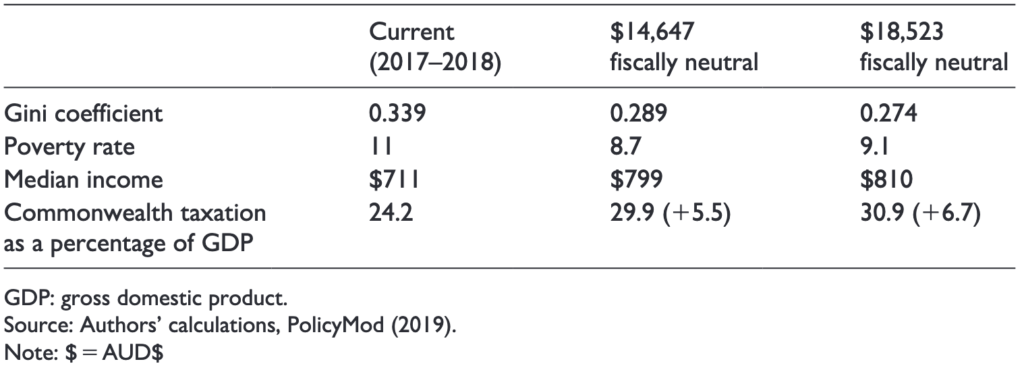

To achieve fiscal neutrality, all marginal income tax rates would need to be increased by 12 percentage points for Model 1 and by 14.5 percentage points for Model 2. We use individual income tax rates for illustrative purposes only and acknowledge that an alternative tax mix may have different fiscal and distributional implications.

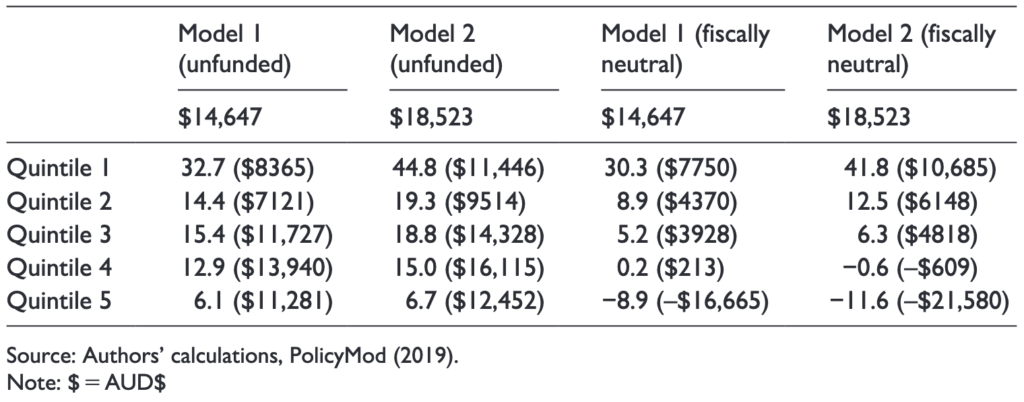

Turning to static distributional effects, both Model 1 and Model 2 deliver significant income gains to middle income earners and reduce inequality and poverty rates (see Tables 3 and 4). Inequality is reduced by 50 to 65 Gini points while poverty rates fall by between 17 per cent and 22 per cent. This would see Australian income inequality fall from 0.337 to 0.274, similar to Scandinavian levels (between Sweden’s 0.282 and Denmark’s 0.263).

Table 3: Distributional impacts of affluence-tested Basic Income proposals. Percentage change in annual equivalised disposable income, (change in dollars).

Table 4: Fiscal and distributional impacts of Basic Income models.

Policy takeaways

We conclude with three main observations regarding this study.

First, our results are consistent with previous research indicating that any reasonable Basic Income payment is likely to have a large fiscal impact, even when incorporating elements of a negative income tax model. However, the model we present is less costly than what might be expected from other recent analysis.

Second, an affluence-tested model of Basic Income appears consistent with the redistributive logic of the current tax and welfare system.

Third, our models help to situate medium- to long-term political choices in framing trade-offs between levels of taxation and inequality.

Finally, we reflect on the relationship between payments, inequality and work. We suggest that moves towards universalism are likely to significantly benefit those on the margins of the labour market and is also is likely to substantially benefit middle-income workers. In sum, affluence testing implies a partial buffer to the loss of income at the margin, while reducing taper rates would improve work incentives for many low-income workers.

We acknowledge that a reform on this scale may not be considered a near-term policy option. At the same time, the COVID-19 policy interventions have opened up the policy space for a more detailed consideration of innovative reform in the sphere of social protection.

We suggest, therefore, that an affluence tested Australian Basic Income represents a realistic medium-term political choice, which might be gradually realised by advancing the relaxation of benefit withdrawal rates over tax cuts, and individualising payments over time.

Yes, this is essential if Australia is to become enlightened about abolishing poverty and involuntary unemployment in the 21st century. It is of particular benefit to women often left underdone by superannuation. It’s always overlooked that it assists business wage costs, insofar as they would only have to offer an amount *additional to* the universal income in order to retain or attract employees. What’s not to like about a win/win for people and business that also resolves industrial relations for all time? Some may ask: “Where’s the money coming from?” From the federal government. It’s paid for the moment it’s spent – and it does not come out of taxation.

I definitely think it’s time Australia embraced a universal basic income. Raising new start worked well and I think was a good trial for this.