When interest rates began to rise, many anticipated a sharp decline in house prices, but this has not been the case. Our research paper, “The impact of negative gearing on the investment decisions of housing investors: the case of Greater Sydney”, published in the Journal of Housing and the Built Environment, sheds new light on this phenomenon. We provide empirical evidence that negative gearing plays a central role in shaping investor decisions, especially in Greater Sydney’s housing market.

Negative gearing: A key driver of investment

Negative gearing allows investors to offset rental losses against personal income, which occurs when rental income is insufficient to cover the costs of property ownership, such as mortgage interest and maintenance expenses. This makes property investment more attractive, even in periods of low rental yields.

Australia’s negative gearing policy is one of the most generous globally, as noted by Luci Ellies (2006), once the Assistant Governor of the Reserve Bank of Australia (RBA). By allowing rental losses to be written off against other income, it provides a substantial tax benefit to property investors.

Findings from Greater Sydney

Our research focused on Greater Sydney, the most expensive housing market in Australia. Using an econometrics analysis of property transactions, rental yields, and investor profiles, we explored how negative gearing influences investment decisions despite low rental yields.

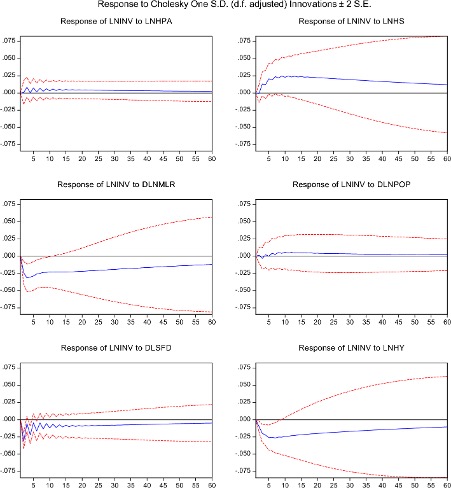

We found that property investors in Greater Sydney are not discouraged by low or negative rental returns. Instead, they use negative gearing to offset losses while relying on future capital gains. This strategy is particularly evident in areas with limited housing supply and high demand, where investors compete with homebuyers for property, further driving up prices. The results are shown in Figure 1.

Our impulse response results measure how investors react to sudden changes in these factors over time, helping us understand the real-world effects of these economic variables on property investment decisions. Our study found that residential investors are willing to accept low housing yields to benefit from capital gains and take advantage of negative gearing. Even as house prices rise and yields fall, investors continue to be attracted to Sydney’s property market. Shocks to housing price appreciation positively impact the number of investors, highlighting the importance of rising property values. Conversely, increases in mortgage lending rates negatively affect investor activity as higher loan payments become less appealing. Housing supply growth and population increases positively impact investor decisions, while stronger economic activity (state final demand) has a negative effect, as higher incomes may lead renters to become homeowners.

Figure 1: The impact of negative gearing on the investment decisions of housing investors: the case of Greater Sydney

Note: Figure 1 presents the various impulse response functions (IRF) over 60-period horizons of residential investors (LNINV) when there is one standard deviation shock to each of natural log of housing yield (LNHY), natural log of housing price appreciation (LNHPA), natural log of housing supply (LNHS), the first difference of mortgage lending rate (DLMLR), the first difference of population (DLPOP), and the first difference of state final demand (SFD).

Methodology: How we conducted our study?

To examine this, our study utilised data from March 1991 to June 2018 to understand how negative gearing and other factors influence people’s decisions to invest in residential properties. We used a model called SVAR (structural vector autoregression) to examine how changes in these factors (like house prices or mortgage rates) affect investor behaviour. This model allows us to investigate the cause-and-effect relationships between these variables over time. Essentially, we examined how investors react to factors like rising house prices, lower rental returns, or changes in mortgage rates.

The broader implications

The results of our study highlight that negative gearing is a key driver in the Australian property market, particularly in Greater Sydney. Even when rental yields are low, the expectation of capital growth, combined with the tax benefits of negative gearing, keeps investors active in the market.

Our findings suggest that any policy changes targeting housing affordability should consider the impact of negative gearing. By recalibrating this tax benefit, the government could not only save billions but also reinvest those savings into increasing housing supply. This would relieve some of the pressure on housing demand and help make homeownership more accessible.

Concluding comments

Negative gearing is deeply embedded in Australia’s housing market, driving investor behaviour even during times of low yields. As our research demonstrates, it plays a crucial role in maintaining investor activity in Greater Sydney. If policymakers wish to address housing affordability, rethinking negative gearing could be the first step toward increasing supply and helping more Australians transition from renting to homeownership.

To be precise, the phrase “negative gearing” is a Treasury abuse of the English language. I was there when they “discovered” it in the 1980s. A negative refers to an arithmetic sum, gearing refers to a ratio. The older term was “loss yield” or “negative yield” and was well known in the 1970s before Treasury “discovered” it.

As for income tax policy, you can’t have it both ways – you either have a tax on global net income or you don’t. Income tax is not the problem – over 60 years of the RBA manipulating real interest rates downwards to subsidise land speculation is the problem. As Mark Twain remarked “Buy land, they’re not printing it any more.”

The sensible tax approach would be a land value tax which reduces market prices as the tax is capitalised. But many politicians are property investors themselves. I wonder how many RBA staff have subsidised real estate loans in Sydney real estate?