A key objective of the Parliamentary Budget Office (PBO) is to support a more informed policy debate. Part of that objective is achieved by providing services to all parliamentarians to estimate the financial implications, or ‘cost’, of their policy proposals. This helps to level the playing field by providing access to costing and other analytical services that, in the absence of the PBO, would normally be exclusively available to the Government. The PBO’s estimates are prepared subject to the same rules and conventions as Government budget estimates.

The PBO is committed to providing transparency in relation to increasing the level of public understanding of policy costings and has released three information papers to support this aim. Together, these papers provide information to help explain, in an accessible way, the underlying data, concepts and methodologies that the PBO uses in preparing costings of policy proposals and budget analyses, what is included in a costing analysis and what drives uncertainty in costing estimates.

What is a Parliamentary Budget Office costing?

The first of the three papers, What is a Parliamentary Budget Office costing?, looks at what is a policy costing and how it is prepared. Every year, the PBO prepares a large number of policy costings for parliamentarians. In 2016–17, for example, we prepared over 1,600 policy costings. Each costing provides an estimate of the proposed policy’s financial implications on the Australian Government Budget over the next decade.

Our objective is to provide independent costings of policy proposals that can be interpreted in the same way as those presented by the Government in the Budget. PBO costings are therefore prepared to the same standards and using the same concepts as Budget costings.

Our costings present estimates of budget impacts on each measure of the budget balance (fiscal, underlying cash and headline cash) and the Government’s balance sheet, where relevant. These costings include estimates of the changes to the revenue or expenditure streams directly associated with the policy as well as any changes in departmental resources required to deliver a policy proposal. A disaggregation of the impacts is usually provided to illustrate the impact on different components of the Budget.

Conceptually, when simulating the impact of a policy proposal on the Budget, we consider three broad impacts:

- The direct static impact of the proposal. This is sometimes referred to as the ‘day after’ impact of the policy proposal. It assumes there is no behavioural response to the policy change on the part of those affected by it. It is an element of all costing analyses.

- The direct behavioural impact of the proposal. This takes account of changes in behaviour by individuals, businesses or organisations directly affected by the proposal, and includes impacts on closely related industries. Behavioural effects are often included in costing estimates where they are likely to have a measurable impact.

- The broader economic effects (or second round effects) of the proposal. These refer to the impacts on the Budget that arise from the further economic feedbacks from a policy change, for instance due to changes in aggregate prices, wages or employment levels flowing on from the introduction of a new policy. With a few exceptions, we do not include quantitative estimates of these effects in our costing estimates for reasons set out in the next section.

To illustrate what we mean by these impacts, let’s look at some examples of direct impacts and broader economic effects. These are set out in Box 1, using the example of an increase in the wine equalisation tax.

Including broader economic effects in policy costings

The second information paper, Including broader economic effects in policy costings, looks at the PBO’s approach to the broader economic impacts of policy proposal and why quantitative estimates of their impact on the budget are rarely included in costing estimates.

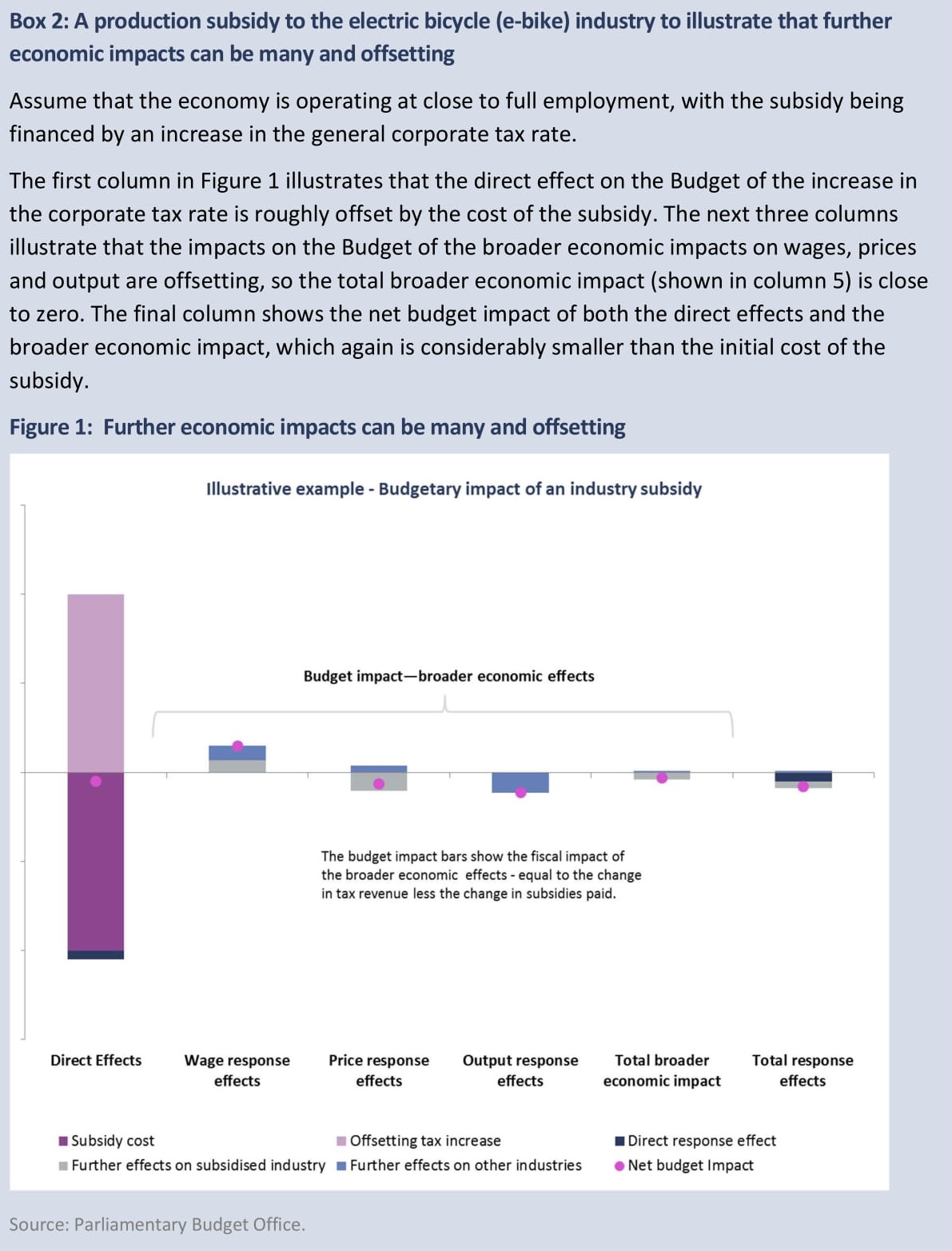

PBO costings routinely incorporate the direct behavioural impacts of the proposal in addition to the direct static impact, on the basis that behavioural responses can be significant and including these impacts improves the accuracy of the costing estimate without introducing too much uncertainty. On the other hand, there are a number of reasons to expect that broader economic effects are less likely to have a material impact on costing estimates and are less likely to be able to be robustly estimated. These are because:

- the broader economic impacts of a proposal are likely to take a longer time to materialise, so that only a small portion of the effect is likely to be observable within the usual costing timeframes of between four and 10 years;

- the broader economic impacts can be comprised of a number of effects that move in different directions, such that the overall direction and magnitude of those effects is unclear;

- the way in which a proposal is financed matters and financing has its own offsetting broader economic impact, so the sum of the broader economic impacts of the proposal and its financing method is generally much smaller than the estimate of the broader economic impact of the initial proposal;

- in many cases, the budget estimates may already include allowance for ongoing policy reforms, with the effect that the broader economic impact of a proposal has already been taken into account and including a further provision would result in double counting.

Some of these points are illustrated in the example in Box 2 below, which considers a policy proposal to provide a production subsidy to the electric bicycle (e-bike) industry.

Consistent with its current approach, the PBO will continue to highlight in its costing responses a qualitative statement when a policy proposal could have material broader economic effects that may affect budget outcomes and cannot be estimated. We will consider incorporating quantitative estimates of broader economic effects into policy costings in limited circumstances where there is compelling evidence of the direction, size and timing of a material economy-wide impact, where the way the proposal would be funded has been made clear and where the broader economic impact can be estimated in a cost-effective manner.

Factors influencing the reliability of policy proposal costings

The third (but first published) information paper, Factors influencing the reliability of policy proposal costings, looks at the factors that affect the level of uncertainty in our costing estimates.

PBO costings are estimates of the financial impact of policy proposals on the Commonwealth Government’s budget that generally cover a future time period of between four and 10 years. Despite being the PBO’s best possible estimates of the budget impact of a policy, all costing estimates are subject to some degree of uncertainty about how closely they would correspond to actual outcomes, were the policy proposal implemented. The level of uncertainty will vary from costing to costing depending upon factors such as data quality, assumptions, methodology, the volatility of the costing base and the magnitude of the policy change.

The PBO is committed to providing transparency in relation to the factors that affect the reliability of the costings it prepares. This means that PBO costings identify those factors that could be expected to make the actual costing outcome, were the policy proposal to be implemented, significantly different from the point estimate provided in the costing.

Pingback: A Speech by the Parliamentary Budget Officer: Fiscal Transparency and the Parliamentary Budget Office - Austaxpolicy: The Tax and Transfer Policy Blog